In this article

- Why It’s Important to Know Commercial Real Estate Terms

- Jump to A Terms

- Jump to B Terms

- Jump to C Terms

- Jump to D Terms

- Jump to E Terms

- Jump to F Terms

- Jump to G Terms

- Jump to H Terms

- Jump to I Terms

- Jump to L Terms

- Jump to M Terms

- Jump to N Terms

- Jump to O Terms

- Jump to P Terms

- Jump to Q Terms

- Jump to R Terms

- Jump to S Terms

- Jump to T Terms

- Jump to U Terms

- Jump to V Terms

- Jump to Y Terms

- Jump to Z Terms

- The GPARENCY CRE Marketplace Platform

- FAQs

GPARENCY is here to guide you on your journey navigating the complexities of commercial real estate. As a commercial building owner and investor, you want to make smart investments in your real estate portfolio. You know it’s important to be familiar with the latest industry jargon and trends, which is why we are here to help! Even experienced investors can find themselves overwhelmed by unfamiliar terms when discussing commercial real estate—from “amortization” to “IRR” to “zoning.” We’ll break down some of the essential vocabulary so you can feel confident as an investor.

Why It’s Important to Know Commercial Real Estate Terms

It is important to know common commercial real estate terms because the industry has its own specific terminology and jargon. Understanding these terms is crucial for effective communication and negotiation, as well as for understanding contracts and legal documents.

Here are some reasons why knowing common commercial real estate terms is important:

- Effective Communication: It can also help you avoid misunderstandings and clarify expectations. Understanding commercial real estate terms can help you communicate more effectively with clients, partners, and other stakeholders in the industry.

- Negotiation: Commercial real estate negotiations often involve the use of specific terms and defining definitions, such as cap rates, rentable square footage, and leasing terms. Understanding these terms can help you negotiate more effectively and avoid misunderstandings.

- Legal Documents: Commercial real estate contracts and other legal documents often contain specialized terms and concepts. Understanding these terms is crucial for understanding the terms of the agreement and ensuring that your interests are protected.

- Professionalism: Knowing common commercial real estate terms demonstrates your professionalism and expertise in the industry. It can also help you build credibility with clients, investors, lenders, and colleagues.

- Efficiency: Understanding commercial real estate terms can help you work more efficiently and effectively, as you will be able to understand and interpret information more quickly and accurately.

Common Commercial Real Estate Terms: A

- Adjustable rate mortgage (ARM): A loan in which the interest rate is changed periodically based on a standard financial index. Most ARMs either have caps on the amount that the rate may increase or they will sell you an option to cap it.

- Amortization: The total amount of time allotted for paying off a loan; commonly set for 25-30 years.

- Anchor tenant: Similar to a boat, an Anchor Tenant holds everything together—it draws the traffic. It’s a major department or chain store that is strategically located in a shopping center that brings traffic to smaller satellite stores.

- Annual constant payment: The fixed annual constant total payment of principal plus interest shown as a percent in relation to the original loan amount. For example, if the principal interest payment is $55,000 and the original loan was $1M, then the constant is 5.5%.

- Appraisal: An opinion or estimate of the value of a property at a given date. The appraisal is the basis for the lender’s determination of the loan amount or LTV. Gross income, underwriting, NOI, and comparables, as well as a physical inspection, are most commonly used to help determine this value.

- Asset-based lenders: Lenders whose primary focus is not the cash flow of a property (see cash flow lenders), but the present value of the property with regards to resale value.

Common Commercial Real Estate Terms: B

- Balloon payment: The full balance due at loan term expiration in the case of a loan that is not fully amortized. For example, a loan with a ten-year term on a 30-year payment schedule will have a balloon payment on its balance at the end of the tenth year.

- Base year: The year a tenant’s pro-rata for reimbursements is based on. This is when a tenant agrees to reimburse a landlord on either a certain or a percentage of all expenses, only above and beyond “x” amount of dollars. The “x” amount of dollars is the total amount of a full calendar year’s expenses from the agreed-upon base year.

- Basis point: One-hundredth of a percentage point (0.01%). 1% equals 100 basis points. Basis points are often used to measure changes in, or differences between, yields, since these often change by very small amounts.

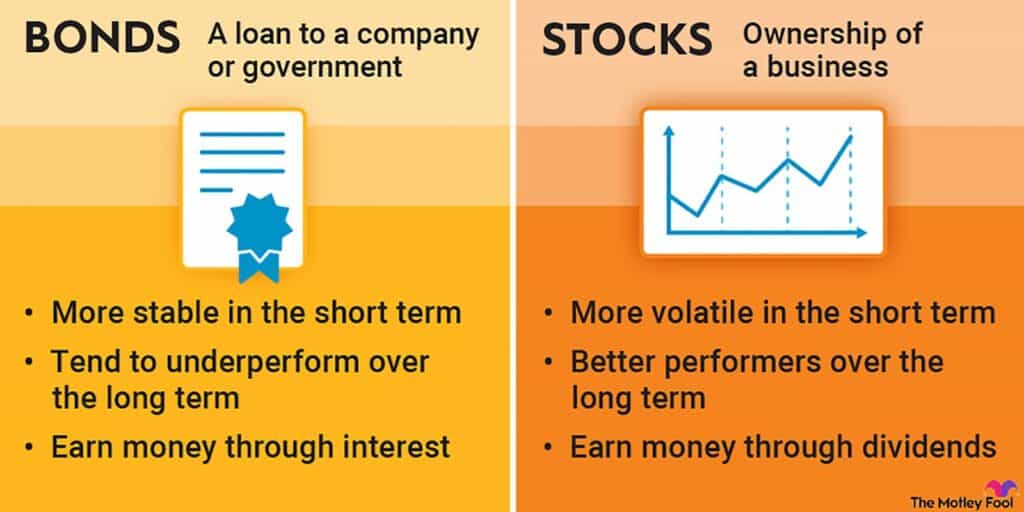

- Bonds: When a company or a government is looking to raise capital, they may “float bonds.” Through this, money is borrowed from the bond purchaser, and he is promised a certain return. Return fluctuates based on the bond’s risk and its demand.

- Bottom line: This usually refers to the NCF (net cash flow), which is the gross income minus all expenses, reserves, and mortgage payments.

- Build-outs: developing raw tenant space; usually the landlord’s responsibility.

Common Commercial Real Estate Terms: C

- Cap rate: The rate of return used to derive the value of an incoming producing property assuming it was only bought with capital (i.e. cash) and no mortgage.

- Cash flow: The amount of money left after all expenses. This is calculated by taking the NOI minus the annual mortgage payments and reserves.

- Cash flow lenders: Lenders who analyze the income of the property and the bottom line (cash flow) to determine how much money they can lend on it.

- Cash-on-cash: The percentage of net cash flow returned on the first year of the investment in relation to the total equity (i.e. down payment and closing costs). For example, if the equity is $300,000, and the net cash flow is $30,000, that works out to a first-year cash-on-cash return of 10%.

- Cash out: The excess money an owner takes out of his property (by refinancing) above the existing mortgage on a property.

- Ceiling: A fixed predetermined point that a floating rate cannot exceed.

- Closing: (1) The act of transferring ownership of a property from seller to buyer in accordance with a sales contract; (2) The time when this transfer of ownership takes place. The closing also occurs at the time of a refinance because, in a sense, the property is renewed to the owner.

- Closing costs: Fees and expenses, such as lawyer’s fees and survey charges, incurred by the buyer and/or the seller, in the property ownership transfer.

- Commercial properties: Historically, this has been multifamily properties including 5+ units. However, recently SFRs and two-to-four families if owned as an LLC are now considered commercial properties. That being noted, in the commercial real estate industry, a “commercial property,” refers to a non-residential property, like a shopping center, an office building, or an industrial building.

- Common area maintenance (CAM): The maintenance expense to upkeep the common areas, such as hallways, lobbies, and parking lots.

- Conduits: Also referred to as CMBS or Wall Street lenders. They make loans to property owners and then sell them off to investors; hence this is why they’re called the Conduits because they are the bridge between the borrower and the investor.

- Construction loan: A short-term loan to pay for the construction of buildings or homes.

- Credit rating: The rating that an agency (such as Moody’s), gives a company. This rating lets investors know what level of risk they are incurring when they do business with that company.

- Credit tenant: A tenant with a credit rating by a reputable rating company (see credit rating above).

Common Commercial Real Estate Terms: D

- Dark tenant: A tenant who closed a store, but is still liable to pay rent until the expiration of their lease.

- Debt: The total amount of loans, mortgages, and liens on a property.

- Debt service: The cost of the annual payments of all the debt, including principal and interest.

- Debt service constant: The constant percent that the total debt service is in relation to the debt.

- Debt service coverage ratio (DSCR): The ratio of the NOI to the debt service; the bank requires an owner to make a certain percentage (usually between 1.2 and 1.3) above the debt service.

- Deed: The document that, when recorded with your local government, determines the ownership of a property. It is transferred from seller to buyer at closing.

- Defeasance: See Prepayment penalty.

- Depreciation: For tax purposes, it is assumed that property wears out over time. The property’s value depreciates over its lifetime to eventually reach $0. This is not an actual out-of-pocket expense, but rather a theoretical expense. This allows the owner to reduce his “taxable income” even though the value or equity of the property may have increased over time. For example, if the actual profit on a building is $300,000 and the depreciation for that year is $250,000, the client only pays taxes on $50,000.

- Down payment: The cash that the buyer puts toward the purchase price. The rest of the money will come from financing.

- Downsize: A reduction of space that a company occupies. Depending on the lease terms, the company may sublet some or all of its space to another tenant.

Common Commercial Real Estate Terms: E

- Earnest money: Money that is submitted with an offer to purchase, indicating a buyer’s seriousness and good faith. In virtually all cases, earnest money needs to be submitted at the time of offer and remains in escrow until the closing, when it becomes part of the down payment.

- Effective gross income: The total actual and potential income from all generated income sources (rents, laundry, parking, etc.) minus the higher of the actual or underwritten collection vacancy.

- Equity: The value the property owner has over any debt owed on the property. Equity = property value—loans and liens against the property. Typically expressed as a percentage of the property value.

- Escrow account: Money held by a third party until conditions of an agreement are met.

- Estoppels: A legal document from a tenant affirming various facts to be true—that they actually occupy space in the stated building and that they pay the stated amount of rent to the stated landlord, etc.

Common Commercial Real Estate Terms: F

- Floor: The minimum amount a lender will accept in interest, regardless of the index at that time.

- Foreclosure: A process in which the lender takes over the property due to the borrower failing to pay his monthly payments.

- Free and clear: A property on which there is no debt.

- Fully amortized loan: A loan in which the entire principal is paid out over the term of the loan. For a 15-year self-amortizing loan, the principal is paid out over 15 years with a zero balance remaining at the end. This is in contrast to a loan in which there is a balloon payment at the end of the term. For example, on a ten-year term with a 30-year amortization, the borrower’s principal payments are calculated as if it was paid out fully over 30 years, but since he is paying it out over only ten years, there will be a lump sum payment due at the end of the term.

Common Commercial Real Estate Terms: G

- Gross potential income: The income the building would produce if fully rented out at market rents. This number is used to assess the value of the building when fully stabilized.

Common Commercial Real Estate Terms: H

- Holdback: This is when the bank holds back a portion of the loan until a certain requirement is met (i.e. if they want the roof fixed, they will hold the money plus a buffer amount in case the budget goes over until the roof is completed).

Common Commercial Real Estate Terms: I

- Income and expense statement (setup): A breakdown of the cash inflow and outflow for a specific property. This is the guts of the deal and is what is ultimately used to set the value of the property.

- Income-producing property: In commercial real estate, an income-producing property is defined as a property that incurs a profit (or, positive cash flow) after applying all the expenses.

- Interest rate: The rate of compensation lenders receive for their service of lending money, generally calculated by adding a certain percentage to their cost of funds.

- Locking an interest rate: In the simplest form, this is a commitment from a lender to the borrower of the actual interest rate that he will be paying when the deal is closed.

Common Commercial Real Estate Terms: L

- Landlord: An owner of a property. They typically rent their property to another party (the tenant).

- Lease: A written agreement under which a property owner allows a tenant to use his property for a specified period of time and rent.

- Lease end date: The date when a lease expires. At the end of the lease, there may be options for the tenant to renew their lease.

- Lease start date: The date a lease actually goes into effect.

- Leasing commission (LC): Commission paid to a leasing agent for finding a tenant to fill a vacancy. The commission is based on the total rent to be paid throughout the life of the lease. The landlord usually pays this fee.

- Letter of intent (LOI): A letter from a lender outlining the general terms of a loan they would be willing to give for a certain property.

- Loan origination fee: A charge imposed by the lender, payable at closing, for processing the loan.

- Loan-to-cost (LTC): The percentage of the total purchase price that a lender is willing to lend on.

- Loan-to-value (LTV): The percentage of the total value of a property that a lender is willing to lend on.

Common Commercial Real Estate Terms: M

- Management fee: The fee that is paid to a company or person to take care of a property. The manager’s duty includes collecting rent, paying bills, and supervising the maintenance of the building.

- Mixed-use properties: A property that contains more than one of the property types, e.g. a property with stores on the ground level and apartments on the second.

- Mortgage: A loan used to finance the purchase of property, using the property as collateral for the loan.

- Mortgage-backed securities: A security created when a group of mortgages is gathered together, and bonds are sold to other institutions or the public. Investors receive a portion of the interest payments on the mortgages as well as the principal payments.

- Multifamily properties: A property that contains multiple residential units, such as an apartment building or garden apartment complex.

Common Commercial Real Estate Terms: N

- Negative amortization: Amortization in which the payment made is insufficient to fund the complete repayment of the loan at its termination. This usually occurs when the rate increases, but the monthly payment is limited by a ceiling. Since the borrower does not have to pay above a certain amount each month, the portion of the payment that should be paid is added to the remaining balance owed. By doing this, the balance of the loan will not be paid off by the original amortization schedule, and therefore the borrower will have to keep paying beyond the initial end date.

- Net operating income (NOI): This is the bottom line; the profits after an owner calculates his gross effective income and subtracts all his expenses (see underwriting). It is the deciding factor by which cash flow lenders determine how much they are comfortable lending or how much a buyer will pay for the property.

- Net income: Gross income minus incurred expenses. For a business, it is the same as net profit. See also Bottom Line.

- Non-recourse: No personal guarantee by the borrower. The security to the lender is the property itself.

Common Commercial Real Estate Terms: O

- Operating expenses: The expenses involved in the day-to-day running of a property.

- Options: An extension of the original loan term. If the original loan term is five years, then an option may be an additional five years. When a borrower takes a loan that has a term shorter than the amortization, he would want to have options to renew at the end of the term. When leasing a property, sometimes a tenant may have the option to purchase the property within a certain time period and at a certain price, potentially applying some of the rent paid previously toward the payment.

Common Commercial Real Estate Terms: P

- Points: Interchangeable with “percent.” Thus, each point usually refers to one percent of the loan. Commonly used to refer to the lender’s or broker’s fees.

- Prepayment penalty (PPP): The amount of money a borrower has to pay his existing lender as a penalty for paying off the loan early.

- Private mortgage insurance (PMI): Insurance that is required on virtually all conventional home loans with less than 20% down payment. Although the payments for PMI are included in your mortgage payment, it protects the lender should the borrower default on the loan.

- Pro-rata share: When discussed with commercial real estate, it usually means the proportion of the total space that a tenant leases in relation to the size of the building, however it also applies to investing in real estate where each partner has to cover their pro-rata share of the investment..

- Purchase money mortgage: A mortgage used to finance the purchase of a property.

Common Commercial Real Estate Terms: Q

- Quote: A verbal statement by the lender following a borrower’s request for financing including the main points of the loan, such as the loan amount, the term, and the interest rate.

Common Commercial Real Estate Terms: R

- Recording: The act of entering deed and/or mortgage information into public record with the local government jurisdiction.

- Recourse: A personal guarantee by the borrower to pay off the loan. Some banks will only lend with this personal guarantee.

- Refinance: Obtaining a new mortgage loan on a property the borrower owns. It is often used to replace existing loans on the property.

- Reimbursements: When tenants agree to pay for certain expenses that the owner will incur, the owner pays the bills, and the tenants “reimburses”, or pays back, the owner for those bills.

- Rent: Monthly payment from the tenant to the landlord, for the use of space or property.

- Rent per square foot: The total square footage a tenant occupies divided by the annual rent.

- Rent roll: A listing of all tenants leasing space within a building or property. It’s typically along with their square footage (and room count for apartments), lease start and end dates, option leases, and any reimbursement income.

- Replacement cost: The cost to rebuild a building from scratch at current prices or construction costs.

- Replacement reserves: An account required by many lenders to ensure that money is available to perform non-regular repairs, such as roof replacement.

- Return on investment (ROI): The return, or profit, that an owner sees from his investment in a property.

Common Commercial Real Estate Terms: S

- Savings bank: A bank that pools the savings of individuals for investment in mortgages. A savings bank takes all of the deposits they have and then they loan, leftover is profit

- Seasoning: The time period that a lender requires a buyer to own the property before they no longer focus on what he paid for it. After this period, many lenders will allow the borrower to borrow as much as the value of the building allows, regardless of how much of his own original equity he will still have left in the deal.

- Securitization: The process by which financial assets that generate a cash flow, such as real estate loans, are pooled together and converted into securities for sale to investors in the capital markets. Potential investors include insurance companies, banks, pension funds, and real estate funds.

- Self-liquidating loan: A loan that is entirely paid off at the end of the term; the term and the amortization run co-terminously.

- Seller financing: See Vendor financing.

- Setup: An income and expense statement (see above) and an itemized rent-roll.

- Sliding scale: It’s a type of prepayment penalty. See Prepayment penalty.

- Spread: The spread amounts to the lender’s profit. The difference between the lender’s cost of funds, typically measured by a certain index rate, and the interest rate they charged the borrower.

- Sublet: To sub-lease some or all of a tenant’s space to another tenant, commonly due to downsizing.

- Syndicator: The person in charge of putting together all the different aspects to arrange for the purchase of a property. For example, if a prospective buyer hears of a building for sale and thinks it is a good deal, but does not have all the money needed to complete the transaction, he’ll go to contract on the property, then syndicate the purchase by finding other people to be partners in the deal. The syndicator will get a part of the ownership for his work in putting the deal together.

Common Commercial Real Estate Terms: T

- Tenant: An individual or business that has possession of, and pays rent for, real estate owned by another party (the landlord).

- Tenant improvements (TIs): Improvements that a tenant can ask the landlord to pay for, upon moving into a new space, or renewing a lease.

- Term: The life of a loan that a bank is committing to stay with the borrower before the borrower will have to refinance. Typically during this time, the rate will be fixed, where the rate quoted remains stable throughout the entire term of the loan. However, in some cases, it can be a floating rate where the rate quoted changes throughout the term of the loan based on a spread above a predetermined index.

- Term sheet: See Letter of intent.

- Title: Evidence that the current owner of the property is in lawful possession; evidence of ownership without any hindrances to his title.

- Title insurance: An insurance policy that protects the insured against loss arising from defects in the title. Defects include liens against the property or the improper recording of the deed.

- Title report: A report from the title insurance company that presents all previous owners of the property and confirms the current owner. It also shows if there are any current liens on the property.

- Tranches: Portions of an investment that are usually broken out by different risk levels, most commonly by a securitization where they will sell off the riskiest loan-to-value portion at a higher rate and the lowest risk portion at a lower rate.

- Triple net lease (NNN): A lease in which the tenant pays rent to the landlord, as well as all taxes, insurance, and maintenance expenses that arise from the use of the property.

Common Commercial Real Estate Terms: U

- Underwriting: The process by which lenders determine the profit of a building by backing up actual numbers and using minimum criteria by expenses (e.g. vacancy and cap rates) to determine values.

- U.S. Treasury bills: The U.S. Treasury issues securities to raise the money needed to operate the Federal Government and to pay off maturing obligations—the U.S. government’s debt. The most common index prices all loans with a spread above the 10-year treasury bill.

Common Commercial Real Estate Terms: V

- Vacancy: The total amount of space in a building that currently does not have a tenant occupying it. Vacancy is typically referred to as the total percentage of space in an occupied building, therefore not producing income. If a 100-unit building has five vacancies, the vacancy of the building is 5%.

- Vacancy factor: Lenders and investors for underwriting purposes typically have a minimum vacancy factor that they subtract from the income, even if all units are occupied. This is done in order to determine what the income would be if several apartments became vacant.

- Vendor financing: Also known as seller financing, this is when the seller provides the loan to the buyer. This occurs in cases where the property is difficult to finance through conventional sources.

Common Commercial Real Estate Terms: Y

- Yield: The percent return.

- Yield maintenance: See Prepayment penalty.

Common Commercial Real Estate Terms: Z

- Zoning: Laws that govern how a zoned area can be used. For example, an area may be zoned for single-family residential, condominiums, commercial or retail, or a mix of two or more uses.

We hope this commercial real estate terms guide will be a valuable resource for you as you navigate the world of commercial real estate. Remember, GPARENCY is here to help with all your commercial real estate needs. With our decades of experience in the industry, we are confident that we can provide you with the advice and guidance you need to make smart investment decisions. Contact us today and we would be happy to answer any questions you may have!

The GPARENCY CRE Marketplace Platform

The GPARENCY CRE Marketplace Platform is an online platform that provides transparency and efficiency for commercial real estate (CRE) investments. The platform allows investors, property owners, and brokers to manage and track their CRE investments in real time, using data and analytics to make informed decisions.

The GPARENCY CRE Platform offers a range of features, including:

Access 50,000+ commercial listings on an interactive map. We have a team searching for updates on listings around the nation, so you always have the latest groundsourced information.

Get alerted when a property changes price or gets listed. Tell us what you’re looking for and get alerted with property updates and pricing changes that match your buyer profile.

Access sales and finance comps, public data, and google street views. We aggregate data and map technology so you no longer have to go to multiple websites to get started with your due diligence.

On the alerted deal, we’ll tell you the best lender rate and terms. We have over 3,000 lender relationships and we’re giving you access. Either go direct, use your own broker, or our banking team can shop the deal to all qualified lenders for you for $4K.

As a member, Have our top-tier mortgage brokers close the deal for you for $11K. Let our team of America’s top closers handle the full process for you from application to close.Overall, the GPARENCY CRE Marketplace Platform offers a comprehensive solution for managing commercial real estate investments, providing transparency and efficiency that can help investors maximize returns and reduce risk.

FAQs

- Why is your credit rating important for a loan?

- When it comes to commercial real estate, the lender is primarily focused on the property. Even so, just to make sure they can trust you to be a good gatekeeper, they use the credit score.

Your credit rating, also known as your credit score, is an important factor that lenders consider when you apply for a loan. A credit score is a numerical representation of your creditworthiness based on your credit history. This score is generated by credit reporting agencies and is used by lenders to assess the likelihood that you will repay a loan on time.

A good credit rating indicates that you have a history of making timely payments on your credit accounts, such as credit cards, loans, and mortgages. This gives lenders confidence that you are likely to repay a loan on time, which makes you a low-risk borrower. As a result, you may be offered more favorable loan terms, such as lower interest rates, longer repayment terms, or higher loan amounts.

On the other hand, a poor credit rating indicates that you have a history of missing payments, defaulting on loans, or having a high level of debt. This makes you a high-risk borrower, which means that lenders may be more hesitant to approve your loan application or may offer less favorable loan terms.

- When it comes to commercial real estate, the lender is primarily focused on the property. Even so, just to make sure they can trust you to be a good gatekeeper, they use the credit score.

- Are balloon payments a good idea?

- Balloon payments can be an option in certain situations, but they may not always be a good idea for everyone. A balloon payment is a lump sum payment that is due at the end of a loan term, after a series of smaller payments have been made. Balloon payments are often associated with loans that have lower monthly payments in the early years of the loan term, but a large final payment due at the end.

The advantage of a balloon payment is that it can make your monthly payments more affordable in the short term. This can be particularly helpful if you have a low income or if you need to keep your monthly expenses low for other reasons. Balloon payments can also be beneficial if you expect to receive a large sum of money, such as an inheritance or a bonus, at the end of the loan term that you can use to make the final payment.

However, balloon payments can also be risky. If you are unable to make the final payment when it is due, you may be in default of the loan and could face penalties or other consequences. Additionally, the final payment may be much larger than you expected, which could be difficult to manage financially.

- Balloon payments can be an option in certain situations, but they may not always be a good idea for everyone. A balloon payment is a lump sum payment that is due at the end of a loan term, after a series of smaller payments have been made. Balloon payments are often associated with loans that have lower monthly payments in the early years of the loan term, but a large final payment due at the end.

- What is considered a “good” interest rate to pay on a commercial property?

- Markets always change—every deal is different—the best rate is created by having competition, commercial real estate is a blend between a science and an art. A good interest rate on a commercial property loan is one that is competitive and reasonable for your financial circumstances. The interest rate that you can expect to pay on a commercial property loan can vary depending on a number of factors, including your creditworthiness, the type of property you are purchasing, the loan term, and current market conditions. As such, it is difficult to say what a “good” interest rate is without knowing more information about your specific situation.

Generally speaking, interest rates on commercial property loans tend to be higher than those on residential property loans. This is because commercial properties are often viewed as higher-risk investments for lenders.

- Markets always change—every deal is different—the best rate is created by having competition, commercial real estate is a blend between a science and an art. A good interest rate on a commercial property loan is one that is competitive and reasonable for your financial circumstances. The interest rate that you can expect to pay on a commercial property loan can vary depending on a number of factors, including your creditworthiness, the type of property you are purchasing, the loan term, and current market conditions. As such, it is difficult to say what a “good” interest rate is without knowing more information about your specific situation.

- Why is there a prepayment penalty on loans?

- A prepayment penalty is a fee that a lender may charge a borrower if they pay off their loan before the agreed-upon term. The main reason a lender might impose a prepayment penalty is to compensate for the loss of interest that would have been earned over the remainder of the loan term.

From a lender’s perspective, the primary goal is to generate revenue through the interest charged on the loan. If a borrower pays off the loan early, the lender loses out on that future revenue. To mitigate this loss, lenders sometimes include prepayment penalties in loan agreements. These penalties serve as a disincentive for borrowers to pay off their loans early, since doing so would result in an additional cost.

In some cases, lenders may also use prepayment penalties to protect themselves from the risk of losing money on a loan. For example, if a borrower receives a low-interest loan, the lender may require a prepayment penalty to ensure they receive the full amount of interest they anticipated.

It’s worth noting that prepayment penalties are not always included in loan agreements, and they may be illegal in some jurisdictions. Before taking out a loan, borrowers should carefully review the terms of the agreement to understand any penalties that may be imposed for early repayment.

- A prepayment penalty is a fee that a lender may charge a borrower if they pay off their loan before the agreed-upon term. The main reason a lender might impose a prepayment penalty is to compensate for the loss of interest that would have been earned over the remainder of the loan term.

Here are some reasons why knowing common commercial real estate terms is important:

Effective Communication: Understanding commercial real estate terms can help you communicate more effectively with clients, partners, and other stakeholders in the industry. It can also help you avoid misunderstandings and clarify expectations.

Negotiation: Commercial real estate negotiations often involve the use of specific terms and concepts, such as cap rates, rentable square footage, and leasing terms. Understanding these terms can help you negotiate more effectively and avoid misunderstandings.

Legal Documents: Commercial real estate contracts and other legal documents often contain specialized terms and concepts. Understanding these terms is crucial for understanding the terms of the agreement and ensuring that your interests are protected.

Professionalism: Knowing common commercial real estate terms demonstrates your professionalism and expertise in the industry. It can also help you build credibility with clients and colleagues.

Efficiency: Understanding commercial real estate terms can help you work more efficiently and effectively, as you will be able to understand and interpret information more quickly and accurately.