In This Article

- What Is Included in a Commercial Loan Analysis?

- Explanation of Commercial Loan Terms

- Delving Deeper Into the Analysis

- Do You Want a Commercial Loan or a Loan Analysis?

- FAQs

What is Commercial Real Estate Loan Analysis?

A commercial loan analysis is a thorough examination of the financial information and creditworthiness of a potential borrower for the purpose of determining whether to approve a commercial loan. The analysis is typically performed by a lender, such as a bank or other financial institution, before deciding to extend credit to a business.

What Is Included in a Commercial Loan Analysis?

A commercial loan analysis typically includes the following steps:

- Review of the borrower’s financial information: This includes the business’s financial statements, tax returns, cash flow projections, and any other relevant financial information.

- Assessment of the borrower’s creditworthiness: This includes reviewing the borrower’s credit history, including their credit score, payment history, and any bankruptcies or foreclosures.

- Evaluation of the collateral: If the loan is secured by collateral, such as real estate or equipment, the lender will evaluate the value of the collateral and its ability to serve as collateral for the loan.

- Analysis of the loan request: The lender will examine the loan request, including the amount of the loan, the purpose of the loan, and the repayment terms.

- Review of the industry and market: The lender will assess the health of the borrower’s industry and the overall market conditions that may affect the borrower’s ability to repay the loan.

The outcome of a commercial loan analysis will determine whether the lender believes that the borrower is creditworthy and able to repay the loan and whether the lender is willing to extend credit to the business. The results of the analysis will also help the lender determine the interest rate and other terms and conditions of the loan, including any collateral requirements.

Sample Commercial Loan Analysis

Banking providers may modify the numbers provided by business owners – no matter how precise they seem- as accounting can be a tricky game. It’s essential to keep this in mind when making financial transactions with banks!

Below is a sample of a commercial loan analysis:

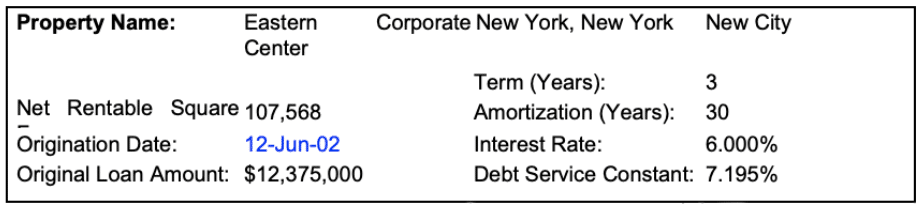

This box (normally found at the top of a loan analysis) provides basic information about the loan—property name and size, as well as basic loan information—date, amount, term, amortization, rate, and constant.

Explanation of Commercial Loan Terms

- TERM: The amount of time the bank commits to a specific rate

- AMORTIZATION: The amount of time allotted for the loan to be paid off. The average commercial real estate loan is for a five-, seven-, or ten-year term, payable on a 25- or 30-year amortization schedule. This means that even though the monthly payments are calculated as if the loan will be paid over 25 or 30 years, the bank only locks its interest rate for the life of the loan, which can be for five, seven, or ten years.

- RATE: The interest rate may be either a fixed rate or a floating rate. A fixed-rate remains constant throughout the term of the loan. A floating rate is based on a spread above a predetermined index which ‘floats’ or changes with that index throughout the term of the loan.

- DEBT SERVICE CONSTANT: Do not confuse the interest rate and the annual constant rate. A bank may issue a commitment with a constant payment of 8.48% and an interest rate of 7%. The difference between the constant and the interest rate is the amount that will go towards amortization—paying off the principal.

Delving Deeper Into the Analysis

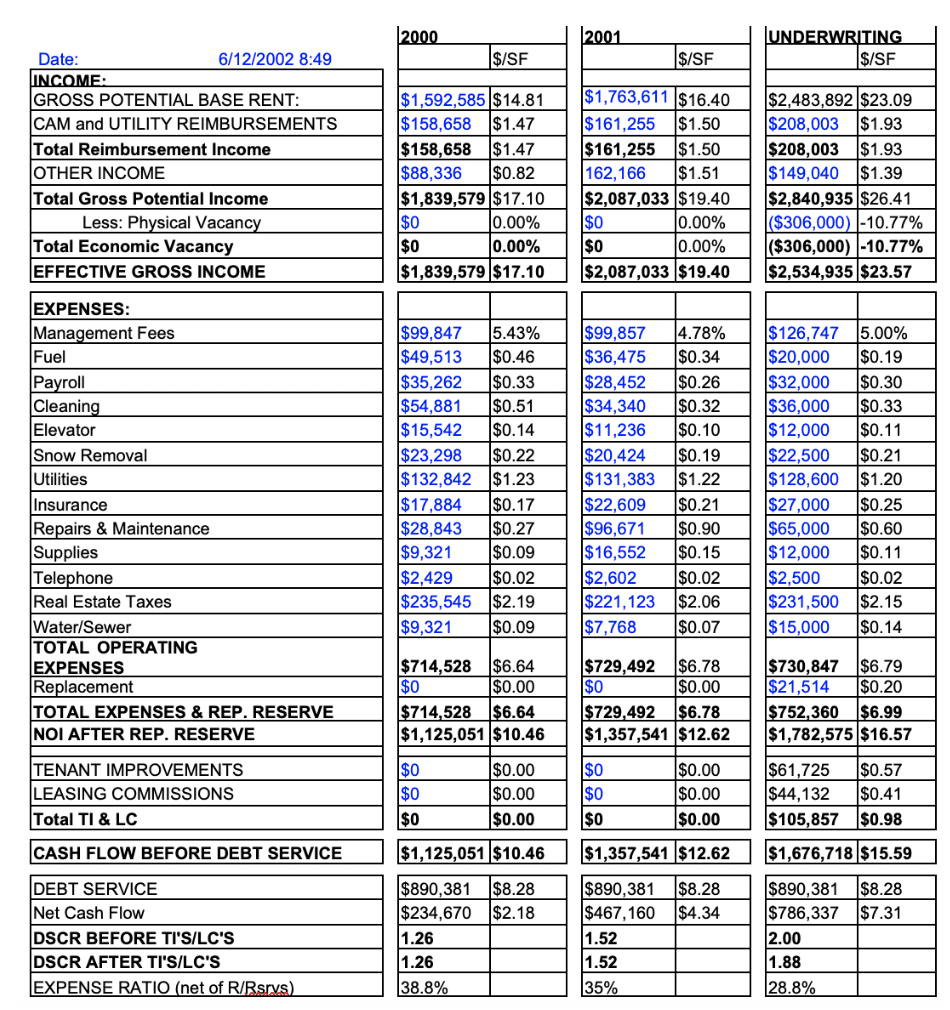

The above loan analysis was prepared in 2001 and contains information for both 2000 and 2001. The underwriting column refers to the bank’s projections for the future for each of the items.

11 Unique Items in the Commerical Loan Analysis

Below is some further explanation of items that are unique to the loan analysis or to the bank’s underwriting.

- GROSS POTENTIAL INCOME: Total income level that could be obtained, assuming that all tenants were to be current with their rent, and assuming market value could be sustained for all vacant spaces.

- VACANCY: Each property type and each market determines what the underwriting vacancy should be. Even though a particular building may have no vacancy at the time of the loan, a lender or buyer must underwrite the property as if it did. The bank must anticipate the possibility of downtime when the space comes up for renewal until a new tenant can be found. Also, tenants can go bad or fall behind which is equivalent to a vacancy loss. A bank underwrites the loan with a vacancy and rent loss of 5%, or the average market vacancy, whichever is higher. When calculating what the vacancy dollar amount, take the gross potential income, which is all of the income of the tenants occupying space plus the market rate for any vacant spaces. Multiply that number by the market vacancy percent for that property. For example, if the average vacancy in a neighborhood is 5% and the gross potential income is $800,000, the vacancy is assigned as $40,000.

- MANAGEMENT FEE: An average property is usually underwritten with a 5% management fee and a larger property with 4%. This percentage is multiplied by the effective gross income. It is common for the owner not to take this expense into account, but to be underwritten by the bank.

- FUEL: The bank underwrites the fuel expense with the estimated cost the bank would have to pay should the bank take over the building. A multifamily property is typically underwritten at market cost. If the owner is paying above market, the bank will use the owner’s number. The bank always takes the higher expense.

- PAYROLL: The labor cost of a super and/or maintenance worker on or off the premises, full or part-time.

- TOTAL OPERATING EXPENSES: This figure reflects the total operating expenses, excluding the money put away for reserves. Total expenses including reserves are on a separate line. Both figures, the expenses with reserves and without, are important, as they shed light on different angles of the value of the building. The value of a building is reflected by the amount of net profit that the building can produce, taking into account all income and expenses. The bank requires that some of that money be put away as reserves. However, that money essentially belongs to the owner and is put in an escrow account for him. When assessing the profits, and therefore value, of a building, that money is counted as income, since it is in fact part of the income of the building.

- REPLACEMENT RESERVES: Replacement reserves are designated for use to cover structural and one-time expenses that arise, such as a new roof or repair of the facade. Replacement reserves for a good quality multifamily property in a decent neighborhood usually amount to about $250 per apartment per year. Commercial properties are calculated based on a price per square foot, usually $0.15 to $0.20 per square foot. Most major banks and financial institutions both underwrite this expense and require the money to be put into an escrow account. Most local banks merely underwrite the expense but don’t collect it.

- TOTAL EXPENSES: This is a reflection of the actual expenses and the underwriting expenses added to the building to reflect the current market and comparable conditions.

- TENANT IMPROVEMENTS (TI): These are typically funded by reserve escrow accounts, often required by the bank. There is no fixed amount allocated for TIs. The bank assesses each loan for future exposure to TIs individually, based on tenant sizes, the going market for TIs, and assumptions of whether or not each tenant will renew their lease or choose to move. After estimating the amount that the owner will need in TIs for the life of the loan, the bank has the owner put a portion of that amount into reserves every month. This portion represents the total estimated amount, divided by the amount of months of the loan. Because the majority of tenant improvements are done early on, the bank may require the landlord to put away more at the time of closing to cover that extra expenses. When there are many tenants’ leases set to expire within the first 12 to 18 months, a lender might hold back an additional amount at closing, since there was not enough time for the owner to build up an adequate TI reserve account. This means that the bank holds back some of the loan amount at the time of closing, and sets it aside for TIs. All monies spent by the owner on tenant improvements is reimbursed by the lender after the work is done or expenses are paid.

- LEASING COMMISSIONS (LC): Divided equally over the duration of the lease. For a ten-year lease, the bank calculates the cost of the LC and divides it by ten, and apportions accordingly.

- CASH FLOW: Cash flow is a vital part of understanding the financial health of commercial real estate. It’s calculated by subtracting tenant improvements and leasing commissions from net operating income to reveal how much cash remains available for mortgage payments.

Do You Want a Commercial Loan or a Loan Analysis?

When your business is expanding, and you’re considering a commercial loan to fuel your growth, it’s important to do a careful analysis of the offer before signing on the dotted line. There are a few key factors you should always look at, including the interest rate, repayment terms, and prepayment penalties. With a little bit of research, you can make sure you’re getting the best deal possible and avoid any potential pitfalls down the road.

We can help! Our team of experts is ready to work with you to connect you with the best financing solution for your business needs. Reach out today and let us get started!

Commercial Real Estate Loan Analysis FAQs:

- What are reimbursements in relation to a loan?

- Reimbursements in relation to a loan refer to payments made by the lender to the borrower to cover certain costs or expenses incurred by the borrower as part of the loan agreement. These reimbursements can be used to cover a variety of costs, such as appraisal fees, loan origination fees, or closing costs.

- Who can do a loan analysis for you?

- A loan analysis can be done by several different types of professionals, depending on the type of loan and the purpose of the analysis. Some of the most common types of professionals who can conduct a loan analysis include:

- Bankers: Bankers, particularly those working in commercial or corporate lending, are trained to analyze the creditworthiness of borrowers and assess the risk of a loan. They can provide a loan analysis for both personal and business loans.

- Financial advisors: Financial advisors, particularly those who specialize in lending and borrowing, can provide a loan analysis and help you understand your options and make informed decisions about your loan.

- Mortgage brokers: If you are seeking a mortgage loan, a mortgage broker can provide a loan analysis and help you find the best loan options available to you.

- Accountants: Accountants, particularly those who specialize in financial analysis, can provide a loan analysis and help you understand the financial impact of a loan, including the interest rate, repayment terms, and overall cost of the loan.

- Credit unions and credit counseling services: Credit unions and credit counseling services can provide a loan analysis and help you understand your options and make informed decisions about your loan.

- A loan analysis can be done by several different types of professionals, depending on the type of loan and the purpose of the analysis. Some of the most common types of professionals who can conduct a loan analysis include: