In This Article

WHAT IS THE RENT ROLL?

When you invest in a property, it’s essential to understand the rent roll. This is a list of all the leased spaces in the property, along with details about each tenant and space. It’s important because it helps calculate the property’s income and expenses, which is crucial in determining its profitability.

There are differences between residential and commercial properties. Commercial rent rolls tend to be more complex, with more variables and details. In this blog, you’ll find a sample rent roll for residential and commercial properties. The commercial rent roll is explained line by line to help you understand any unfamiliar terms.

By examining the rent roll alongside the income and expense statement, you can better understand the property’s financial situation. It helps determine whether the property is likely to be profitable. So, take the time to understand the rent roll and how it relates to the income and expense statement, to make informed investment decisions.

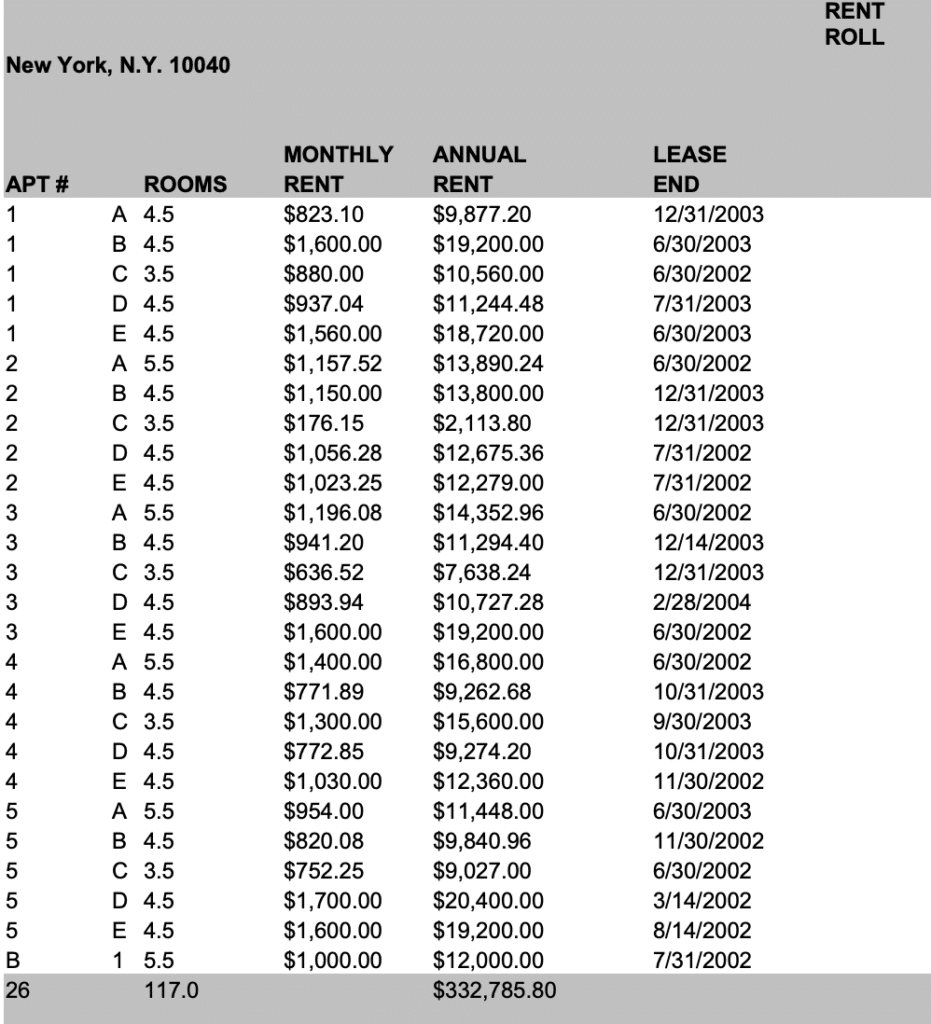

RESIDENTIAL RENT ROLL

If you’re just beginning in real estate investing, it’s important to understand what a residential rent roll is. It’s a list of all the apartments in a property, along with some basic information about each one. This information may vary, but it typically includes the number of rooms, rent per month, and lease end date.

By reviewing the rent roll, an investor can make some basic calculations about the property’s potential profitability. For example, it’s essential to know how many apartments have a large number of rooms, as these tend to rent first during a down market. This can help the investor anticipate potential losses or gains.

Another important factor to consider is the lease end date. This is because a large number of leases ending around the same time can result in a higher vacancy rate, which can affect the property’s profitability. It’s important to consider the lease end dates when making investment decisions.

Below is a sample of a basic residential rent roll.

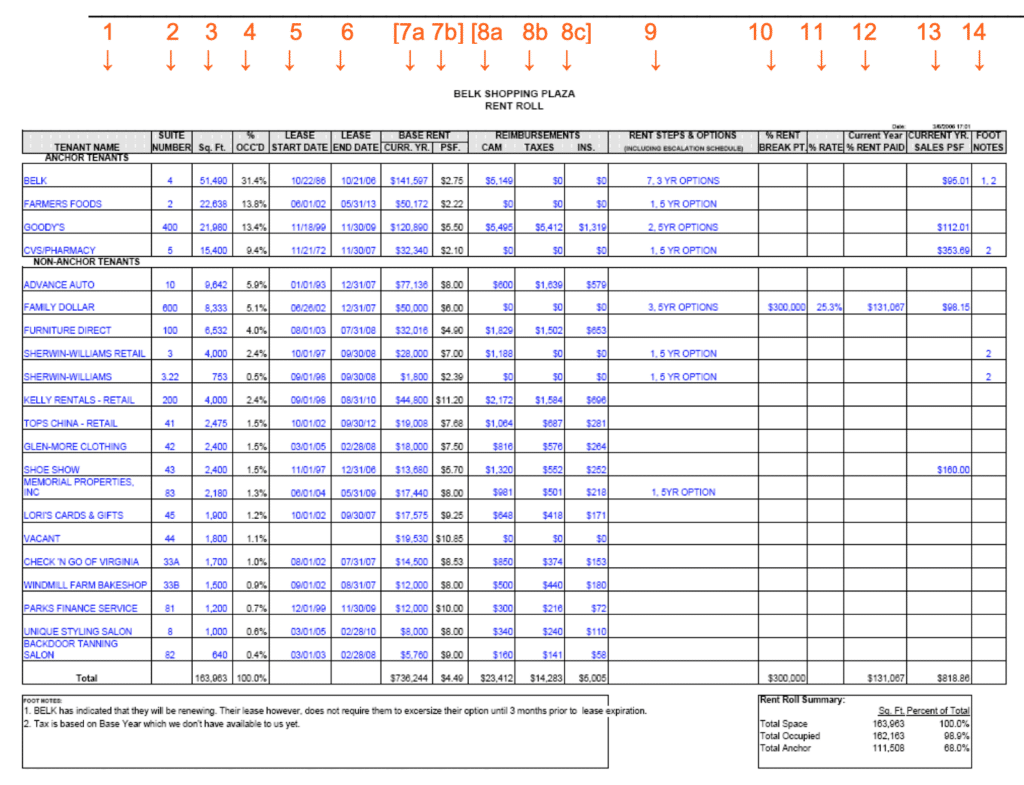

COMMERCIAL RENT ROLL

Here is an example of a commercial rent roll for a fictional property called the “Belk Shopping Plaza.” This sample rent roll is typical of what you might see for commercial properties, with some details specific to shopping centers. To make it easier to reference, each column is numbered in red above the column.

Note: All numbers are annual.

The numbers below correspond to the numbers printed in red above each column:

- Tenant Name: A prospective buyer of a commercial property will first scan the list of tenant names to familiarize himself with the type of tenancy occupying the property. He wants to see how much of the tenancy are ‘brand-name’ tenants. The success of a shopping center is proportionate to the strength and drawing power of its brand-name tenants.

- Suite Number: This identifies by number the space each tenant occupies.

- Sq. Ft. (Square Feet): The number of square feet that each tenant occupies. Naturally, the tenants that take up a large area must be given the closest scrutiny.

- % OCCD (Percent Occupied): This gives the amount of space that each tenant occupies as a percentage of the space of the entire property. It is another way of judging the size and relative importance of each tenant.

- Lease Start Date: Many rent rolls give the move-in date instead of the lease start date. The move-in date is more telling regarding the staying power of the tenant than the lease start date.

- Lease End Date: The date that each tenant’s lease expires.

- Base Rent: The set amount of rent for which each tenant is responsible for the present year. At times, the monthly rent of each tenant will also appear. In a rent roll, the ‘rent,’ entry usually refers to the base rent and does not include reimbursements. See also line 11 in this rent roll for ‘percent rent.’ The base rent number is expressed in two ways:

- 7a—CURR. YR (Current year): The amount of rent to be paid for the current year.

- 7b—PSF: The amount of rent to be paid by the tenant Per Square Foot. This is the number of the rent divided by the square feet that the tenant occupies. Thus, Belk, for example, has a rent of $2.75 psf. This is $141,507 (the base rent, column 7a) divided by 51,400 (square footage for Belk, column 3). This number is given based on the annual rent, not the monthly rent.

- Reimbursements: The annual amount of reimbursements paid for each of the subdivisions:

- (8a) Common Area Maintenance (CAM)

- (8b) Taxes

- (8c) Insurance

- Rent Steps and Options: Typically, a tenant’s rent amount does not remain the same over the lifetime of the lease. Rather, it is increased annually in steps. Step-ups may be a predetermined fixed amount or a percent increase over the previous year’s rent. The nature of the step-up in each tenant’s lease is listed here. This box may say, for example, “3.75% incr. annually”, meaning that the rent is raised 3.75% above the previous year each year.

‘Options’ refers to the agreement with the tenant that after the lease is up, the tenant has the privilege to extend the lease for another term as specified. For example, the ‘options’ box may contain the following information: “One 5-yr. @26 – 2@ $28.50”. This means that the tenant can renew for one 5-year lease with a $26 psf rent and two additional 5-year leases for $28.50.

This information is an essential supplement to the lease end date. Although a particular lease may expire soon, you’ll need to consider the possibility of the tenant taking advantage of his options. - % Rent Break Point (Percent Rent Break Point): An agreed-upon percentage of any profits above this point is paid to the landlord in a ‘percent rent’ system.

- % Rate: This is the percentage of the profit that is paid in the percent rent system. See line 10 above.

- Current Year % Rent Paid: This is the amount of the percent rent paid to date for the current year.

- Current Year Sales PSF: Used in determining the percent rent.

- Foot Notes: These details do not fit neatly into any of the above categories yet are important enough to affect the general picture of the property. See the notes corresponding to these numbers at the bottom of the rent roll page.

On the lower right side of the rent roll is a summary containing the totals for the most basic figures, such as size, occupancy, and anchor tenants.

PER SQUARE FOOT (PSF)

You will notice, in commercial rent rolls and in many other real estate documents, that many of the numbers are expressed in absolute terms and Per Square Foot (psf) (see above, columns 7b, 13). The reason for this is to facilitate easy and clear comparisons between various data about a property. One example of a comparison made easier by the psf, follows:

Landlords need anchor tenants for the success of a property and are willing to give them much better terms and lower rents. Skimming through the absolute base rent numbers in the commercial rent roll above, this is not immediately apparent since the overall rents of the anchors are more than those of the ancillary tenants. However, looking at the ‘psf rent’ column (7b), you will see that the anchor tenants are indeed getting a much better deal. The absolute rents are only larger because the anchor tenants occupy more space.

A buyer needs to be able to compare the rents being charged in a particular property with comparables in the neighborhood. Using the ‘psf rent,’ it can be easily determined how much more one tenant is paying for the same space as another. Or, you could compare how much square footage one tenant gets for the same price. It is important to know if the tenants are paying above or below market rent to assess the risks of a tenant leaving. The comparable market rents are based on the rent a tenant pays on a psf. basis.

We Can Help

If you’re a commercial real estate company or investor, The GPARENCY CRE Marketplace platform will be beneficial to you because we provide a transparent and efficient way to manage and track commercial real estate investments. Our platform is the perfect commercial real estate network for investors.

You can access real-time data and analytics, identify areas of potential risk, and make informed decisions about your investments. Additionally, the GPARENCY CRE Marketplace platform can help investors save time and reduce costs associated with managing their real estate investments, which can be especially important during times of economic uncertainty.

Overall, the GPARENCY commercial real estate network platform can help investors navigate the challenges of a recession and maximize their returns on commercial real estate investments.

FAQs:

- What is a percent rent break point?

- A percent rent break point is a common feature in commercial real estate leases. It is a point at which the landlord’s share of the tenant’s sales revenue increases as a percentage of the total revenue generated by the tenant’s business.

Typically, a commercial lease will have a base rent that the tenant pays each month or year, along with a percentage of their gross sales revenue. The percent rent break point is the point at which the percentage of gross sales paid as rent increases.

For example, let’s say a retail tenant has a lease with a base rent of $5,000 per month and a percent rent of 5% of gross sales over $500,000. The percent rent break point would be $500,000, meaning that once the tenant’s sales revenue exceeds $500,000, they would start paying 5% of their total sales revenue as rent, in addition to the base rent.

Percent rent break points are often negotiated in commercial leases to ensure that the landlord shares in the success of the tenant’s business. They can also provide some protection for the tenant, as they only pay a percentage of their sales revenue once they reach a certain level, rather than from the start of the lease.

- A percent rent break point is a common feature in commercial real estate leases. It is a point at which the landlord’s share of the tenant’s sales revenue increases as a percentage of the total revenue generated by the tenant’s business.

- Where do you get the information for a rent roll statement?

- A rent roll statement is a document that provides a summary of the rental income generated by a commercial property. It typically includes information about the current and previous tenants, their rental rates, lease terms, and other relevant details.

To prepare a rent roll statement, the following information is generally required:

- Tenant Information: You need to collect information on each tenant occupying the property, including their name, contact information, lease start and end dates, rental rate, security deposit, and any other applicable lease terms.

- Lease Information: You need to collect information about each lease agreement, including the length of the lease term, renewal options, and rent escalation clauses.

- Vacancy Information: You need to identify any vacant units and record information such as the length of time they have been vacant and the monthly rental rate.

- Payment History: You need to record the payment history of each tenant, including any late payments or missed rent payments.

- Other Charges: You need to identify any additional charges that may be applicable, such as common area maintenance charges or utility charges.

This information can typically be gathered from a variety of sources, including lease agreements, tenant correspondence, and financial records. Property management software may also be used to help generate rent roll statements quickly and accurately.

It’s important to keep rent roll statements up-to-date and accurate to ensure that property owners have a clear understanding of their rental income and can make informed decisions about the management of their properties.