In This Article

- “The Setup” Documents

- What Is The Income and Expense Statement?

- Sample Income and Expense Statement

- Pro Forma

- We Can Help

- FAQs

“THE SETUP” DOCUMENTS

If you’re considering investing in a property, having all the necessary information is critical to make an informed decision. That’s why you’ll be given a set of documents known as ‘the setup,’ which includes the income and expense statement and the Rent Roll.

These documents provide critical figures that determine the value, purchase price, net operating income (NOI), and cap rate of the building. In this blog, I’ll help you understand the income and expense statement and its significance in evaluating a property. As a broker, it’s crucial to understand these figures clearly to provide sound advice to clients.

As a potential investor, you can obtain a set of documents known as ‘the setup,’ which includes the income and expense statement and the Rent Roll. These documents contain critical figures determining the building’s value, purchase price, net operating income (NOI), and cap rate. A knowledgeable broker can help guide you through these figures and provide sound advice to help you make a balanced decision.

It’s essential that, if you’re a broker, you are familiar with these documents, know which numbers to look at, and how to understand them. This chapter explains the basics of the income and expense statement.

In this blog, we’re focusing on the income and expense statement. We’ll dive deeper into the rent roll in another blog.

WHAT IS THE INCOME AND EXPENSE STATEMENT in COMMERICAL REAL ESTATE? What is the I/E?

The income and expense statement (or the ‘financials’) is a summary of the annual net income of a property, broken down into individual sources of income as well as expenses.

Typically, the income and expense statement lists each income and expense category for the current year and previous years. The historical data is essential for identifying trends in specific categories, which can be valuable for potential buyers or current owners. By aligning the information for each category for consecutive years, any anomalies become apparent, enabling owners to make informed decisions. Recognizing these trends and anomalies is critical to identifying areas for improvement and maximizing the property’s potential. Keep an eye out for these insights when reviewing income and expense statements!

There are times when an income and expense statement will include a forecast for the next year based on previous trends and forecasted expenses (see also below, 7.3). The statement may also include a brief property description and other basic information.

What Should Be Included on a Commercial Real Estate Income and Expense Statement?

A Commercial Real Estate Income and Expense Statement, often referred to as an income statement or profit and loss statement, provides a summary of the financial performance of a commercial property over a specific period. Here are the key components that should be included:

- Rental Income:

- Base Rent: The fixed rent agreed upon in the lease.

- Additional Rent: Any additional charges such as common area maintenance (CAM), property taxes, and insurance.

- Operating Expenses:

- Property Management Fees: Fees paid to property management companies.

- Property Maintenance and Repairs: Costs associated with maintaining the property.

- Property Taxes: Taxes levied on the property by local authorities.

- Property Insurance: Insurance premiums for the property.

- Utilities: Costs for utilities such as water, electricity, and gas.

- Common Area Maintenance (CAM): Expenses related to common areas shared by tenants.

- Administrative Expenses: Other administrative costs associated with the property.

- Net Operating Income (NOI):

- Calculated by subtracting total operating expenses from the total rental income.

- Depreciation:

- Non-cash expense accounting for the gradual wear and tear of the property.

- Debt Service:

- If there is a mortgage on the property, the principal and interest payments should be included.

- Capital Expenditures:

- Large, infrequent expenses for property improvements or replacements.

- Vacancy Loss:

- Estimate for potential income loss due to unoccupied units.

- Other Income:

- Income from sources other than rent, such as parking fees or late fees.

- Total Income:

- Sum of rental income and other income.

- Total Expenses:

- Sum of operating expenses, depreciation, debt service, capital expenditures, and vacancy loss.

- Net Income:

- Calculated by subtracting total expenses from total income.

It’s important to note that the specific categories and details may vary depending on the property type, local regulations, and reporting standards. Additionally, investors and stakeholders may have specific requirements for the information presented on the income and expense statement.

SAMPLE INCOME AND EXPENSE STATEMENT

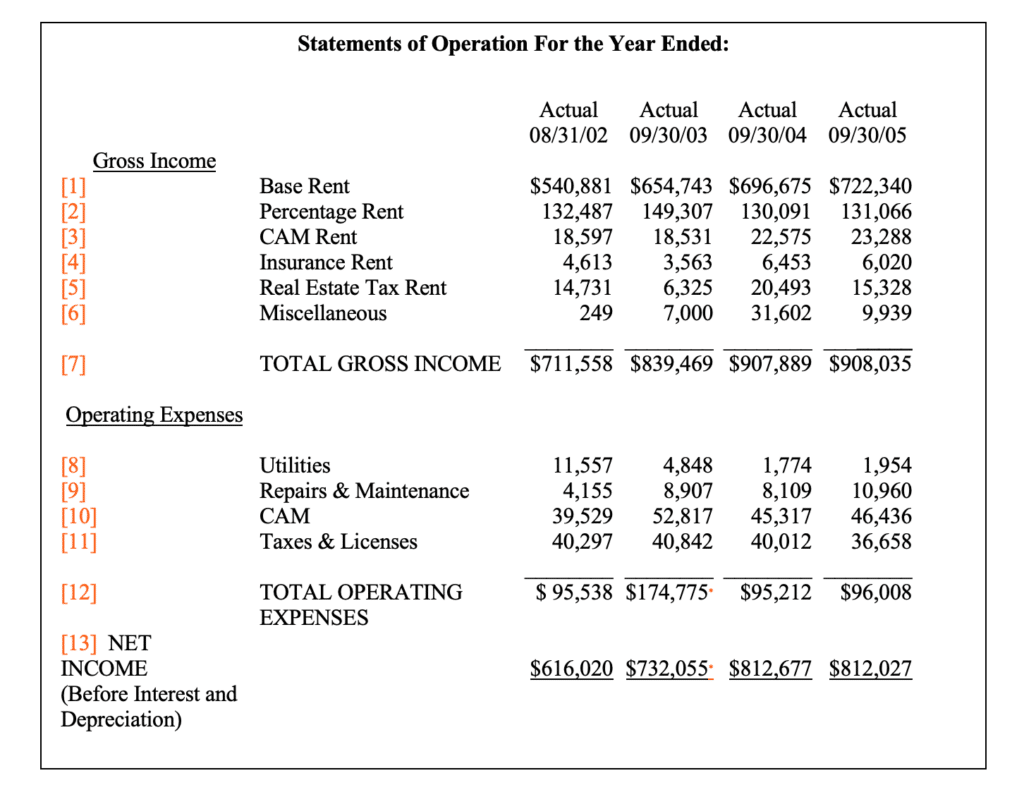

Below is a sample income and expense statement of a commercial property. The numbers on the document’s left (in orange) were inserted for reference. They are not part of the income and expense statement. However, please note that all the numbers in each category reflect annual figures.

Income and Expense Statement Template

A Line by Line Explanation of Income and Expense Statement Template

The above income and expense statement is divided into two sections: The Gross Income, broken down into its individual components, is at the top of the page. The Operating Expenses, divided into their individual components, are at the bottom. There are four columns of numbers representing three previous years and the present year. In this case, the present year is labeled as 2005.

Here is a line-by-line explanation of the entries of the orange numbered rows:

[1] Base Rent: The set amount of rent for which each tenant is responsible for the present year. At times, the monthly rent of each tenant will also appear. In a rent roll, the entry for ‘rent’, usually refers to the base rent and does not include reimbursements.

[2] Percentage Rent: Percentage rent is a lease agreement used in commercial real estate where the tenant pays a base rent amount plus a percentage of their sales revenue to the landlord. The percentage rent is typically calculated as a percentage of the tenant’s gross sales exceeding a predetermined amount called the “breakpoint.” This type of lease is often used in retail spaces where the landlord may want to share in the tenant’s success. The amount of rent the tenant pays is tied to their sales performance.

[3] CAM Rent or Common Area Maintenance Rent: This income consists of the tenant’s reimbursement for the cost of maintaining the common area of the property. The common area is any area of the building not rented out to a specific tenant but used by all, such as hallways, stairs, elevators, lobbies, and parking lots.

CAM is often paid by each tenant pro rata. At times, it is paid using the escalation clause. Another popular method for CAM reimbursement is to charge each tenant a fixed amount each month.

[4] Insurance Rent: Both pro-rata and escalation approaches are used; however, the pro-rata method is the more common.

[5] Real Estate Tax Rent: This is the tenant’s reimbursements for the landlord’s real estate taxes. Again, this is arranged using the pro-rata or escalation methods.

[6] Miscellaneous, or ‘other’: This represents any income from sources other than renting space to tenants. The most common examples are parking, laundry, and antenna roof leases.

[7] Total Gross Income: The sum of all the sources of income listed above.

[8] Utilities: Some income and expense statements list the fuel and the water-sewer expense separately. In that case, the ‘Utilities’ listing refers only to the electricity expense.

[9] Repairs and Maintenance: The cost of the day-to-day repairs and upkeep of a property. Note: This is only for day-to-day repairs, such as the repairing of a boiler, which are included in this entry. Replacing a boiler, or any other large-cost improvements to a building, are called ‘Capital Improvements.’

[10] CAM: See [3] above. The numbers listed here represent the total amount spent on maintenance, including the amount reimbursed by the tenants. All expenses must be listed in full in the section for expenses. The net cost to the landlord for the CAM, the amount not covered by the tenant’s reimbursements, is reflected in the Net Income line [13].

[11] Taxes and Licenses: Regarding reimbursements, the taxes and license fees are calculated using either the pro-rata or escalation methods.

[12] Total Operating Expenses: The sum total of all the expenses listed in the previous four rows.

[13] Net income (Before Interest and Depreciation): This is also called the Net operating income (NOI). This is the effective gross income less the total operating expenses.

Interest refers to the amount paid toward the interest on the loan.

Depreciation refers to the dollar amount deducted from the original value of capital assets.

Understanding a property’s profitability is crucial for making informed investment decisions. One tool used for this purpose is the interest and expense statement, which compares the profitability of a property to similar ones in the market. However, it’s important to note that the mortgage payments for the property are not included in the income and expense statement. This is because the mortgage can be set up in various ways, depending on the borrower’s needs and capabilities. Two properties may appear identical, but if one uses most of its income to pay the mortgage while the other uses only a small percentage, it doesn’t mean that the latter is inherently more profitable. To compare similar properties, the income and expense statement must present the Net Operating Income (NOI) before debt service.

What is The Net Operating Income (NOI) Statement for Real Estate?

The NOI is a critical metric that reflects the actual profitability of a property, excluding mortgage payments. By focusing on the NOI, investors can get a clear picture of the property’s inherent profitability and potential for growth. The NOI is calculated by subtracting all operating expenses from the property’s gross income. This includes expenses like property taxes, insurance, maintenance, and management fees. The resulting number is the property’s income before deducting the mortgage payments.

These are the general components of the income and expense statement from the buyer’s perspective.

Why is the Net Operating Income So Important to Determine?

The NOI (Net Operating Income) is an important metric in real estate investing because it represents the income generated by a property after all of the operating expenses have been subtracted. This metric is used to evaluate the profitability of a property, as it provides a clear picture of the property’s ability to generate income.

What is a Pro Forma in Commercial Real Estate?

The income and expense statement documents actual income and expenses for present and previous years. Another document, the pro forma, focuses on predicting future value and income for the building. Past income and expense patterns are evaluated to make this projection, as well as any planned renovations or investments into the building. Outside factors, such as a rising real estate market or an expected increase in consumer traffic, are also considered.

In commercial real estate, a pro forma is a financial projection of the expected income and expenses of a property, typically used to evaluate the potential profitability of a real estate investment.

A pro forma statement typically includes projected income and expenses for the property, including estimates for potential rental income, operating expenses such as property taxes and maintenance costs, as well as any financing costs associated with the acquisition or development of the property. The purpose of a pro forma statement is to provide investors with a clear picture of the potential financial performance of a property before making an investment decision.

Pro forma statements are often used in conjunction with other financial metrics, such as the net operating income (NOI) and the capitalization rate (cap rate), to help investors evaluate the financial viability of a potential investment opportunity. By projecting future income and expenses, investors can assess the potential return on investment (ROI) of a property and make informed decisions about whether to invest in the property.

We Can Help

If you’re a commercial real estate company, The GPARENCY CRE Marketplace platform can be beneficial during a recession because we provide a transparent and efficient way to manage and track commercial real estate investments. Our platform is the perfect commercial real estate network for investors.

You can access real-time data and analytics, identify areas of potential risk, and make informed decisions about your investments. Additionally, the GPARENCY commercial real estate platform can help investors save time and reduce costs associated with managing their real estate investments, which can be especially important during times of economic uncertainty.

Overall, the GPARENCY CRE commercial real estate network platform can help investors navigate the challenges of a recession and maximize their returns on commercial real estate investments.

FAQs:

- Why is the Net Operating Income so important to determine?

- The NOI (Net Operating Income) is an important metric in real estate investing because it represents the income generated by a property after all of the operating expenses have been subtracted. This metric is used to evaluate the profitability of a property, as it provides a clear picture of the property’s ability to generate income.

- What is a pro forma in commercial real estate?

- In commercial real estate, a pro forma is a financial projection of the expected income and expenses of a property, typically used to evaluate the potential profitability of a real estate investment.

A pro forma statement typically includes projected income and expenses for the property, including estimates for potential rental income, operating expenses such as property taxes and maintenance costs, as well as any financing costs associated with the acquisition or development of the property. The purpose of a pro forma statement is to provide investors with a clear picture of the potential financial performance of a property before making an investment decision.

Pro forma statements are often used in conjunction with other financial metrics, such as the net operating income (NOI) and the capitalization rate (cap rate), to help investors evaluate the financial viability of a potential investment opportunity. By projecting future income and expenses, investors can assess the potential return on investment (ROI) of a property and make informed decisions about whether to invest in the property.

- In commercial real estate, a pro forma is a financial projection of the expected income and expenses of a property, typically used to evaluate the potential profitability of a real estate investment.

- Where do you get the information for the Income and Expense Statement for Commercial Real Estate?

- The information for an Income and Expense Statement for commercial real estate can be obtained from various sources, including:

- Property Management Records: The property management company can provide records of income and expenses, including rent rolls, utility bills, repairs and maintenance expenses, and property taxes.

- Tenant Leases: Tenant leases can provide details on rental income, lease terms, and any expenses that are the responsibility of the tenants, such as common area maintenance fees.

- Property Tax Records: Property tax records can provide information on property taxes and any special assessments.

- Insurance Records: Insurance records can provide information on insurance premiums and any claims made on the property.

- Vendor Invoices: Invoices from vendors, such as contractors and maintenance companies, can provide details on expenses related to repairs and maintenance.

- Historical Financial Statements: Historical financial statements can provide information on income and expenses from previous years.

- The information for an Income and Expense Statement for commercial real estate can be obtained from various sources, including:

It’s important to ensure that the information obtained is accurate and up-to-date to create a reliable Income and Expense Statement for commercial real estate.