In This Article

- Assessing A Deal

- Checking Out the Numbers

- Due Diligence in Purchasing a Property

- Asking Questions

- Checking the Facts When Purchasing a Property

- The Actual Purchase

- Financing

- We Can Help

- FAQs

If you know a little about buying and selling commercial real estate, you might find this blog interesting. It will show you the typical steps that an investor takes when they find a property they want to buy, up until the point when they finally buy it.

Just so you know, this blog only gives a general overview of the process. There are a lot of complicated details and legal stuff that we won’t cover here. But you’ll get a good idea of the main things that happen between when someone first offers to buy a property and when they actually become the owner.

ASSESSING A DEAL

When an investor hears about a potential deal, the first thing that is done is to get acquainted with the property being offered. This includes both physically checking out the building and doing a basic financial overview.

Drive-By Assessment

In this first stage of review, all that is necessary as far as physical inspection is to drive by the building so that one gets a feel for the condition of the building and the character of the neighborhood. In this way, an investor will see if the property meets his investment needs and expectations.

For example, if he is looking only for a steady source of rental income and is not interested in spending major capital on renovations, he will avoid a building that looks neglected. A poorly maintained building in a run-down neighborhood, even if presently fully occupied, will not stand the test of time. In a down market, quality tenants will have the choice to avoid such buildings, and the property will empty of its income-producing tenants.

If he is willing to invest in renovations, it is important to see the quality of the building so that he can properly factor in the cost of the needed renovations into his offering price.

CHECKING OUT THE NUMBERS

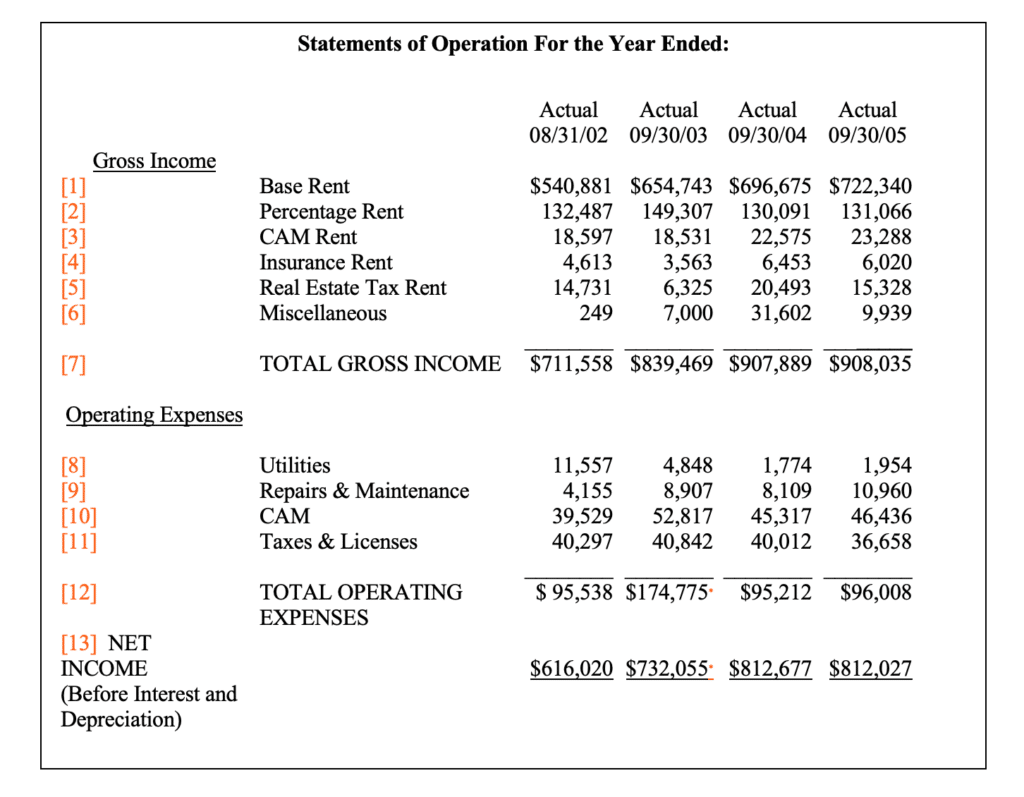

The second thing a potential buyer does is to ask for the setup – the income and expense statement and itemized rent roll for the property. Many times these documents will come as part of the sales offering. The sales offering is a brief description of the property offered for sale and a summary of its basic information. An investor will find in the sales offering the asking price, location, square footage, cap rate, and age of the building. An income and expense sheet and rent roll as well as pictures of the property and its immediate surrounding area will be included. The sales offering may also include other information such as a site plan and sales figures for the major tenants of the previous years.

Before going further, an investor must determine if the profits and rates of return are suitable for his investment needs. This is done by checking out the net operating income (NOI) provided together with the price of the property and then calculating the expected ROI and cash-on-cash return. If the numbers match his expectations, he can go further in his survey of the numbers.

At this point, there are some quick calculations that he can do to ascertain that the asking price is fair. For example, he can check to see if the price matches the value indicated by the cap rate. Take the case of the Belk Shopping Center provided at the end of this chapter as an example. A quick review will show that the offering price of $9,200,000, is below what is indicated by the cap rate. The cap rate, listed on page 2 in the ‘Offering Summary’, is 8.82%. Applying this to the NOI of $812,027 for the present year (the ‘Financials’, page 2) yields a value of $9,206,655.

The basic observations described above by no means take the place of an adequate investigation into all aspects of the property. These are merely an investor’s way of becoming acquainted enough with the property to decide if it is a deal worth pursuing.

DUE DILIGENCE

The next step is to perform due diligence with regard to the property. This means making a reasonable effort to ascertain that all the information the buyer is given is accurate and to find any other information about the property which can affect the sale. Due diligence is the responsibility of the buyer.

Regarding the information in the setup, there are two aspects to this investigation: Checking the numbers and checking the numbers against the facts on the ground.

ASKING QUESTIONS

When reviewing the income and expense sheet, it is imperative that an investor asks about any inconsistency he sees. There is no detail about a potential property too small for an investor to ask his broker or contact about. Any unanticipated increase in a particular expense over the course of a few years must be understood. Even if the expenditure for a valid expense, such as taxes, is unexpectedly low, the buyer must find out the reason. It is important to make sure that there is no inappropriate activity going on that can put his future profits from the property at risk.

As an illustration, see the income and expense statement for the Belk Shopping Center below. Under the ‘miscellaneous income’ entry (line [6]) for the year 2004, there is an unusually high number. The buyers should find out what is behind that ‘miscellaneous’ expense. This document may also cause a prospective investor to ask the following questions: What was the very large and non-recurring expense for utilities (line [8]) in the year 2002? Why, if utility expenses usually rise, do the utilities here generally decrease? Why were there seemingly very few taxes paid (line [11]) for the year 2003? This may be due to the way the tax year and the financial year intersect, but it is something that must be asked.Sometimes there can be a mathematical inconsistency in the setup. For example, in the above I/E., the net income (line [13]) listed for the year 2003 does not equal the amount of the gross income (line [7]) less the total operating expenses (line [12]) as it should. A buyer must find the mistake and then check with the seller to make sure that it was indeed only a mathematical mistake, not a reflection of an inherent inconsistency. [In this case, the mistake is in the addition of the column of expenses for that year. The correct number, $107,414, does yield the net income displayed.]

CHECKING THE FACTS

Generally, the number initially given for the NOI will not stand the test of a thorough investigation by the buyer and will go down. For example, many times, there are expenses that are not included in the NOI, such as vacancy and maintenance. It also must be ascertained that all the numbers that are given, reflect the actual incomes and expenses. One of the steps in due diligence is securing estoppels from each listed tenant. Estoppels are legal documents that the buyer receives from the tenants, affirming, among other things, that they actually occupy space in the stated building and that they pay the stated amount of rent to the landlord.

Another example of information that may be revised upon investigation, is the cap rate percentage. The given cap rate may be based on a certain market without taking the sub-market or recent growth of the industry into account. The buyer may ask an appraiser to re-appraise the cap rate for the property, which can, in turn, lower the price for the building.

Through due diligence, the buyer gains an accurate picture of the property and is in a position to make the decision to purchase or not to purchase.

THE ACTUAL PURCHASE

With any serious offer to purchase, the buyer must submit earnest money. This money is given to indicate his seriousness and good faith, and remains in escrow until the time of closing. At that point, it becomes part of the down payment.

At this point, a buyer will order title insurance. This is an insurance policy that protects the insured against loss arising from defects in title. It guarantees a buyer that nothing is wrong with the property and that no old claims will surface after closing. The title company runs title reports which reveal all previous owners of the property and confirms that the seller is the current owner. It also shows if there are any current liens on the property.

Once the full reports are assessed, the title company will insure the title of the property. It typically takes about three to four weeks to get title insurance. A closing is impossible without a clean report and title insurance.

FINANCING

The average commercial property is worth millions of dollars, money that most real estate investors do not have lying around. So, how does an investor get his hands on the money necessary to make a purchase?

The answer, of course, is that he borrows it. Who does he borrow from, and how much can he borrow? What is the cost of borrowing? How does the lender ensure the return of the money? To answer these questions, it is important to have a thorough understanding of the financing process.

We Can Help

At GPARENCY, we can help. Whether you’re looking for debt or equity, our expert banking and brokerage teams can help you finance your next deal. With our network of 3,000+ lenders, we’ll

find you the best lender to close your deal.

As we work to close your deal, you’ll be able to:

- See all offers from lenders

- Connect directly with lenders to communicate and transact with them

The right lender for you is out there, and we’ll make it our priority to help you find them.

FAQs:

- What is a down market in commercial real estate?

- In commercial real estate, a “down market” refers to a period when the demand for commercial properties is low, and the supply of available properties is high. This typically results in lower property values, reduced rents, and longer periods of time for properties to remain on the market without being sold or leased.

During a down market, investors may have difficulty finding tenants or buyers for their properties, and may need to lower their prices or offer incentives to attract interest. Tenants may also have more negotiating power, as landlords may be more willing to offer lease concessions in order to fill vacancies.

- In commercial real estate, a “down market” refers to a period when the demand for commercial properties is low, and the supply of available properties is high. This typically results in lower property values, reduced rents, and longer periods of time for properties to remain on the market without being sold or leased.

- What is title insurance in commercial real estate?

- Title insurance is a type of insurance that protects commercial real estate buyers and lenders against losses due to title defects or disputes. Title defects can arise from a variety of reasons, such as incorrect or incomplete property records, liens, encumbrances, errors in public records, or fraud.

When a commercial property is sold, the title company performs a title search to ensure that the seller has a clear and marketable title to the property, meaning there are no outstanding claims or disputes over ownership. If any issues are found during the search, the title company works to resolve them before the sale closes.

Title insurance is typically purchased at the time of sale and provides protection against losses that may arise from any undiscovered title issues that were not detected during the title search. This insurance can cover legal fees and other costs associated with defending a title claim, as well as any losses resulting from a defect in the title.

Title insurance is generally required by lenders as a condition of approving a commercial real estate loan and is also recommended for buyers to protect their investment in the property.

- Title insurance is a type of insurance that protects commercial real estate buyers and lenders against losses due to title defects or disputes. Title defects can arise from a variety of reasons, such as incorrect or incomplete property records, liens, encumbrances, errors in public records, or fraud.