In This Article

- Commercial Real Estate: A Good Deal

- Uncovering the Reality of Cash Flow: The Importance of Cash-on-Cash Return

- Balancing Investment Considerations: The Interplay of IRR, Cash-on-Cash, and Other Key Factors

- Understanding the Commercial Real Estate Individual Investor

- Maintaining Value: Assessing a Commercial Real Estate Property’s Value Through Appraisal

- FAQs

Anyone who has been involved in real estate investment has heard that classic initiation of the real estate purchase, “Have I got a deal for you.” At one time or another, you’ve probably heard about deals that sounded good or bad for one of the parties. However, as you get more involved in real estate, you will see the truth in the saying, “There is a buyer for every property in America.”

Everybody has different reasons for buying and for selling. A property that one person wants to get off his hands might be exactly what someone else is looking for. Often, you hear from a seller that he was thrilled about his selling price. Perhaps he had bought the building years ago when it was worth less and now wants to sell the property for a profit and retire. Or perhaps the building’s neighborhood and condition required too much money and management, and he just wants to walk away with what he perceives to be a fair price. Speaking to the buyer in the very same deal, you may hear that he sees the building as a great acquisition. He may feel that he can invest energy, time, and money into the property and eventually raise its income and value.

Commercial Real Estate: A Good Deal

A good deal boils down to two things: are you buying it right, and are you getting the return you want?

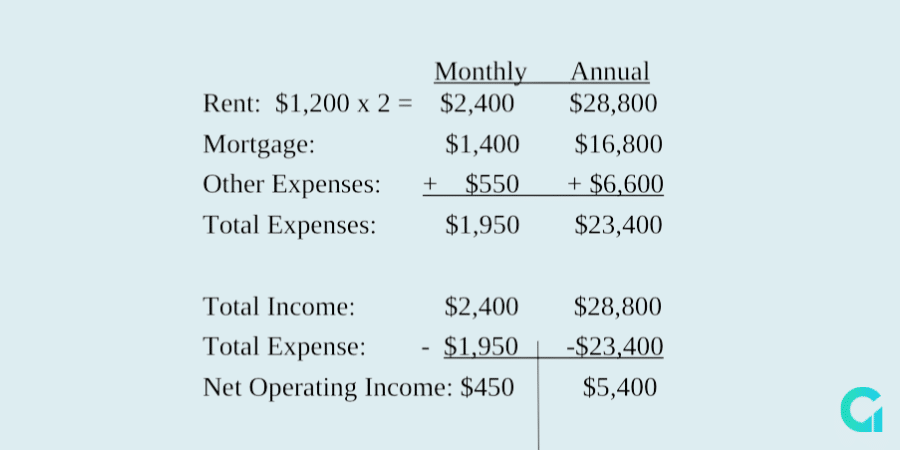

Let’s say a two-family house went up for sale in your neighborhood for $160,000. You want to ensure that it has value and you can get the right return on it for the money you’re investing. How would you go about deciding if it is a worthwhile investment? Naturally, the first thing you want to find out is the amount of profit that the building could bring you. Suppose your initial inquiries yield the following information:According to the prevailing market, each apartment could be rented for $1,200 per month. Monthly payments for the mortgage (the loan for the acquisition of the building), come to $1,400. All other expenses for maintenance and repair of the building are estimated at $550 a month, bringing the total expenses to $1,950. With a total income of $2,400 a month, (2 apartments at $1,200), and expenses of $1,950, the Net Operating Income (NOI) is $450 a month, or $5,400 a year. The Net Operating Income is the bottom line profit of a building and is calculated by subtracting all expenses from the gross effective income.

Four hundred and fifty dollars in your pocket every month certainly sounds good, but does it necessarily mean that it is a worthwhile investment? To find out, you must apply the Internal Rate of Return. The IRR is the basic measure of a good investment because it doesn’t just take into account the first year of profits; it’s an indicator of whether or not your profits are going to continue to grow every year and if you’ll make a profit when you eventually sell the property. In other words, it’s an average of what your return will work out to when taking into account first-year growth as well as final sale profits.

That’s why the IRR is such an important metric to consider—it encompasses the full life of the investment. It measures the annual percentage of the original actual investment that returns to the buyer as profit. This number is the most reliable indicator of how profitable a deal is. The higher the IRR, the stronger your money is working for you.

If you only put down 10% of the costs—or $16,000—$450 a month would be a great return on your investment. On the other hand, if you had to put up 50% of your money—$80,000—it wouldn’t be a worthwhile investment.

Of course, there are several other factors that go into these calculations. For example, let’s say you have a high projected IRR of 15% on a property. It sounds like a great investment in theory, but if you’re reinvesting every dollar you earn during the initial stages of building, you may not have sufficient cash flow. In that case, it would be more beneficial to invest in a deal that doesn’t bring in as much profit over time but will provide adequate cash flow.

Although this high-level example doesn’t take into account every factor these calculations may encompass, it demonstrates the fundamentals of what makes an investment worthwhile.

Uncovering the Reality of Cash Flow: The Importance of Cash-on-Cash Return

Aside from being able to ascertain how strong an investment is, an investor wants to predict how much cash he can expect to get back from the deal and how quickly he will get it. For most investors, who do not have unlimited cash reserves, it is important to know how quickly cash will become available so that the money can be used for future deals. The IRR, which takes into account all net profits from a property including those not available as cash, cannot provide this information. For this information he needs to look at the cash-on-cash return. The cash-on-cash return is defined as the percent return on the buyer’s actual out-of-pocket costs, down payment plus closing costs, less the annual operating expenses, reserves, and annual debt service payments. Since the cash-on-cash considers all destinations of outgoing cash (such as reserves) as expenses, it is an accurate indicator of the cash that is actually available annually.

Once an investor decides on a cash-on-cash return that he is comfortable with, he can then use that percentage to weed out any deals that are not appropriate for his investment needs.

Balancing Investment Considerations: The Interplay of IRR, Cash-on-Cash, and Other Key Factors

The IRR that an investor usually seeks for a minimal-risk investment is 12% to 15%. The cash-on-cash percentage, however, shows how much the investor is actually taking out of that on a year-by-year basis starting with year one. There are countless angles to take into account on each deal and different investors approach investments from different perspectives. Here are 4 of the most common factors which affect any investment:

Safety of Investment

The safer an investment is, the less return that an investor will demand to see for it. For example: If a six-family house became available next door to where he lived, although your calculations show only an 8.5% IRR, it could still be considered a good investment, since your familiarity with the area makes it a safer-than-average investment. Keep in mind that over time you can build up equity, meaning that the value of the building will likely increase, you would invest even without making your 12% to 15% goal.

Development Potential

A buyer may consider a property at a price of $1,100,000 and make the following calculation: “This building has an NOI of $72,967 and may only be worth $1,000,000. However, if I do certain improvements, upgrade these items, or extend the building, within a year it can be worth $1,500,000.” This buyer would be willing to overpay today with a price of $1,100,000 and then invest an additional $200,000 towards renovations since when all is said and done, he hopes to increase the NOI and thereby bring the overall worth of the property to $1,500,000. The $100,000 extra that he paid for the building, plus $200,000 in renovations will have been well worth it.

Financial Instincts

An investor may disregard the actual number of the IRR in his conviction that the building is worth more than the NOI indicates. He may be relying on his years of experience in the field, or he may know, based on owning other similar properties in the neighborhood, how much he could raise the rents to or how much such a building will sell per square foot.

Location

A buyer may overpay because he is planning on using his purchase as an owner-occupied property and this location will give him a higher natural value. The same principle is illustrated by the sale of one-family homes where the price is based on location, not on the potential income that a given house could produce.

Understanding the Commercial Real Estate Individual Investor

The dominant factor that affects every deal, however, is the unique personality and situation of the investor. Everyone invests his money in different places based on his own perception of risk vs. reward. A deal that seems risky for one investor may seem reasonable to another. All investors have different budgets, circumstances, and outlooks. What an older investor might consider an undue risk might be considered by a younger investor to be a great opportunity.

As a broker, it is important to recognize with whom you are dealing. Knowing the individual client and his situation is the first requirement in representing his interests.

Maintaining Value: Assessing a Commercial Real Estate Property’s Value Through Appraisal

Despite projections for healthy profits, an experienced investor only goes through with a purchase if he is convinced that he can recoup the initial purchase price in the case that he has to sell the property. In order to assure this, the prospective buyer must have an appraisal (estimation of value) done on the property. The appraiser will tell him what the real value of the building is at the present and give an estimate of its future value.

FAQs:

- What is cash-on-cash return and how does it help an investor in property investment? The cash-on-cash return is a metric that measures the actual cash return on an investment property, taking into account the out-of-pocket costs, down payment, closing costs, and all annual expenses including operating expenses, reserves, and debt service payments. This metric provides the investor with an accurate indication of the first year’s annual available cash flow from the investment and helps the investor determine if the investment fits their target return.

- How do the personality and situation of an investor affect their investment decisions? Every investor has a unique perception of risk vs. reward, and their investment decisions are influenced by their personal circumstances, budget, and outlook. As a broker, it is important to understand the individual investor and their situation to effectively represent their interests. Recognizing the client’s personality and situation is the first step in making informed investment recommendations and ensuring their success.

- What are some minimal-risk investment options in commercial real estate? There’s no right or wrong answer to this, everyone has a different view. The industry accepted views on several investment options in commercial real estate that offer low risk for investors are:

- Real Estate Investment Trusts (REITs): These are professionally managed portfolios of commercial properties that are bought and sold on the stock exchange.

- Commercial Real Estate Funds: These are mutual funds that invest in commercial properties and offer low risk due to the diversification of assets.

- Buy a Deal Yourself or Bring in an Investor to Maintain Control: Investing directly in commercial properties can be a low-risk venture if approached correctly. One option is to purchase a deal yourself, allowing you to maintain full control over the investment. By acquiring stable, income-generating properties with a strong tenant history and positive cash flow, you can mitigate risks and potentially achieve long-term financial growth.

- Invest as an LP: Participate in commercial real estate ventures alongside experienced operators or general partners (GPs) who manage the properties. This approach allows you to invest capital while relying on the expertise of the GP, who takes the lead in property management and decision-making. Investing as an LP can provide an opportunity to diversify your portfolio and potentially benefit from the income and appreciation generated by the commercial properties.